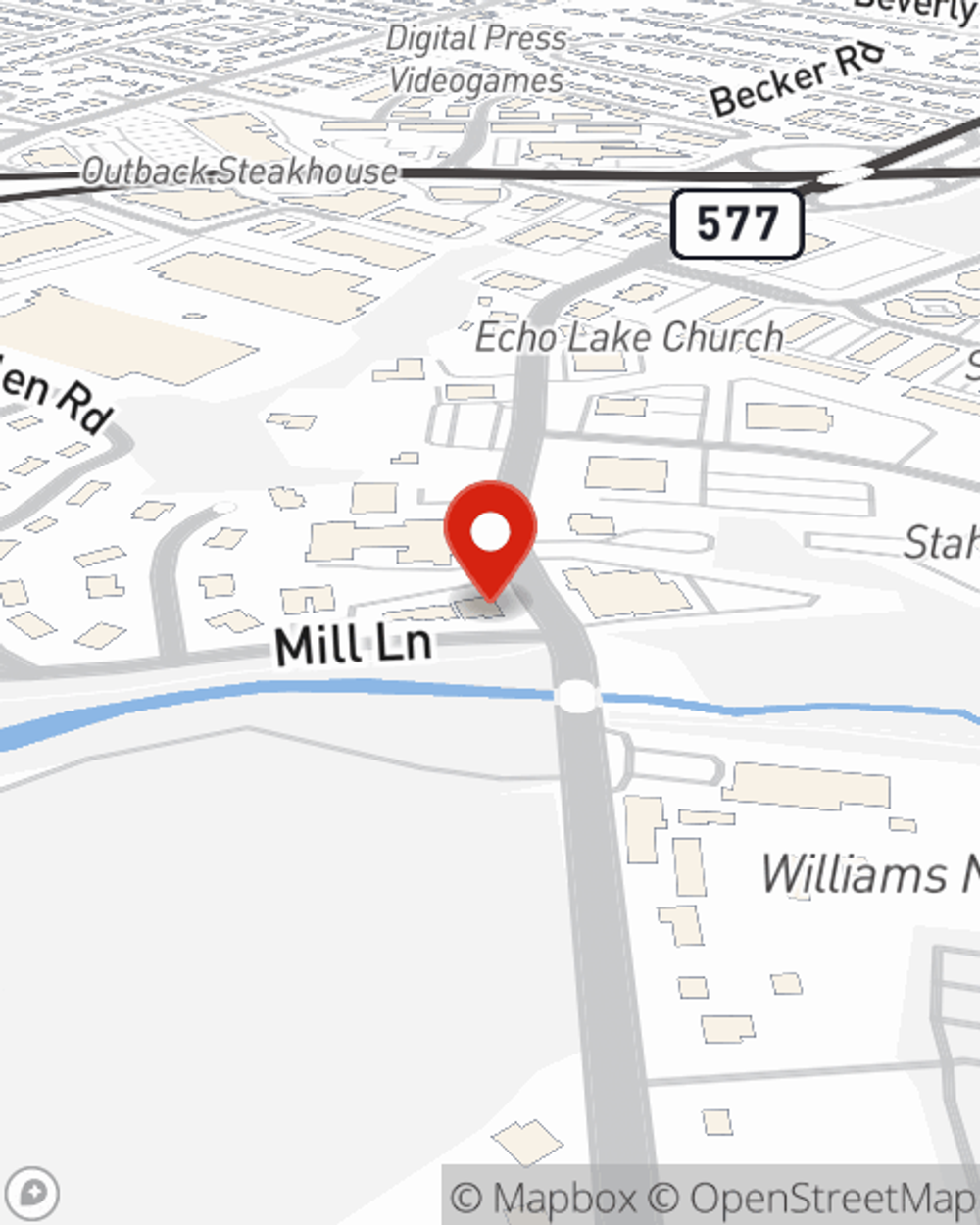

Auto Insurance in and around Mountainside

Auto owners in the Mountainside area, State Farm can help with your insurance needs.

Insurance that lets you take the front seat

Would you like to create a personalized auto quote?

- Mountainside

- Cranford

- Westfield

- New Providence

- Union

- Summit

- Scotch Plains

- Springfield

Be Ready For The Road Ahead

Choosing your auto insurance provider doesn't have to be overwhelming. With State Farm, you can be sure to receive reliable coverage. Among the plethora of options out there for deductibles and coverage options, State Farm makes the decision easy.

Auto owners in the Mountainside area, State Farm can help with your insurance needs.

Insurance that lets you take the front seat

Agent Peter Romeo, At Your Service

State Farm offers reliable flexible coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are a few of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Peter Romeo can verify which ones you qualify for to make a policy for your individual needs.

Plus, your coverage can be matched to your lifestyle, to include things like Emergency Roadside Service (ERS) coverage and car rental insurance. And you can cover a variety of vehicles—whether it's a RV, business vehicle, motorhome or classic car.

Have More Questions About Auto Insurance?

Call Peter at (908) 232-1111 or visit our FAQ page.

Simple Insights®

Teen driving 101: a step-by-step test of essential driving skills

Teen driving 101: a step-by-step test of essential driving skills

Learn some tips on how to teach a teen to drive in a safe manner. Also take a look at this skills checklist to see if your teen is ready to drive on their own.

Pedestrian safety tips

Pedestrian safety tips

Pedestrian safety is achievable with these simple steps to keep you and your loved ones safe whether you’re walking or behind the wheel.

Peter Romeo

State Farm® Insurance AgentSimple Insights®

Teen driving 101: a step-by-step test of essential driving skills

Teen driving 101: a step-by-step test of essential driving skills

Learn some tips on how to teach a teen to drive in a safe manner. Also take a look at this skills checklist to see if your teen is ready to drive on their own.

Pedestrian safety tips

Pedestrian safety tips

Pedestrian safety is achievable with these simple steps to keep you and your loved ones safe whether you’re walking or behind the wheel.